Have you recently stumbled upon an unfamiliar entry labeled “NWEDI” on your bank statement, sparking questions about its origin and implications? Fear not; this comprehensive guide is designed to decode the mystery behind NWEDI on your bank statement, addressing key questions and providing valuable insights into the significance of this enigmatic charge.

What Does NWEDI Stand For?

The acronym NWEDI stands for Nationwide EDI, where EDI refers to Electronic Data Interchange. Nationwide Building Society, a prominent financial institution in the United Kingdom, utilizes this system to streamline payment processes and facilitate secure transactions with various business entities.

NWEDI EDI PYMNTS | What’s This Charge on a Bank Statement?

Encountering the notation “NWEDI EDI PYMNTS” on your bank statement might initially raise eyebrows. This entry signifies Nationwide’s utilization of Electronic Data Interchange for payments. Let’s break down the components:

- NWEDI: Nationwide’s Electronic Data Interchange.

- EDI: Electronic Data Interchange, a standardized communication method for exchanging business documents.

The “PYMNTS” tag indicates a payment-related transaction within the EDI framework, emphasizing the electronic nature of the payment process.

Nwedi Payments On Bank Statement

Navigating through your bank statement, you might come across entries specifically denoted as “Nwedi Payments.” Understanding these entries requires insight into Nationwide’s payment mechanisms. Nwedi Payments signify transactions processed through the NWEDI system, reflecting Nationwide’s commitment to efficient and secure electronic payment methods.

What Does NWEDI on a Bank Statement Mean?

Delving deeper into the meaning of “NWEDI” on your bank statement unveils its role as an integral part of the Nationwide Building Society’s payment infrastructure. NWEDI is a shorthand representation of the Electronic Data Interchange system employed by Nationwide for various financial transactions. When you spot NWEDI on your bank statement, it signifies that a particular transaction, such as a payment or transfer, has been conducted through this electronic framework.

Understanding NWEDI’s Role in Nationwide

Nationwide, like many forward-thinking organizations, has embraced Electronic Data Interchange to enhance the efficiency and security of its payment processes. NWEDI allows Nationwide to electronically exchange payment instructions, invoices, and other related documents with its network of business partners, vendors, and suppliers. This electronic method ensures seamless, error-free transactions while reducing paperwork and expediting payment settlements.

The NWEDI system offers a fast, reliable, and accurate means of exchanging payment data. By automating payment workflows, Nationwide minimizes errors, enhances security through encryption and authentication measures, and increases overall efficiency by eliminating the need for paper-based documentation and manual reconciliation.

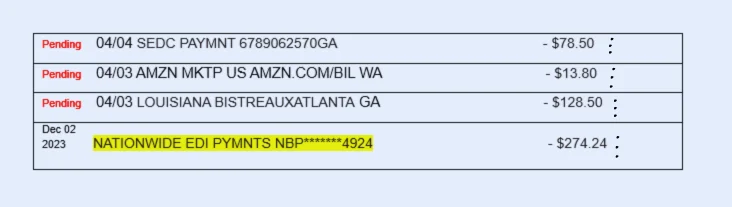

How Does NWEDI Appear on Your Bank Statement?

The appearance of the NWEDI charge on your bank statement may vary based on your bank’s labeling conventions. Below is a table showing various possible descriptions of how the NWEDI charge might appear on a bank statement:

| Description | Meaning |

| NWEDI Payment | Payment processed through NWEDI |

| Nationwide EDI Payment | Electronic Data Interchange payment |

| NW EDI Charge | Charge related to Electronic Data Interchange |

| NWEDI Transaction | Transaction facilitated by NWEDI |

| Nationwide Building Society EDI | EDI transaction associated with Nationwide Building Society |

| NW Charge | Charge utilizing the NW system |

| NW Payment | Payment made through the NW system |

| Nationwide Electronic Payment | Electronic payment linked to Nationwide |

| NWEDI Fee | Fee associated with NWEDI transactions |

| NWEDI Service Charge | EDI transaction associated with the Nationwide Building Society |

| Nationwide Electronic Data Interchange | Electronic data interchange with Nationwide |

It’s essential to carefully review your bank statement, identifying any transaction descriptions that reference NWEDI, Nationwide Building Society, or Electronic Data Interchange to accurately recognize the charge.

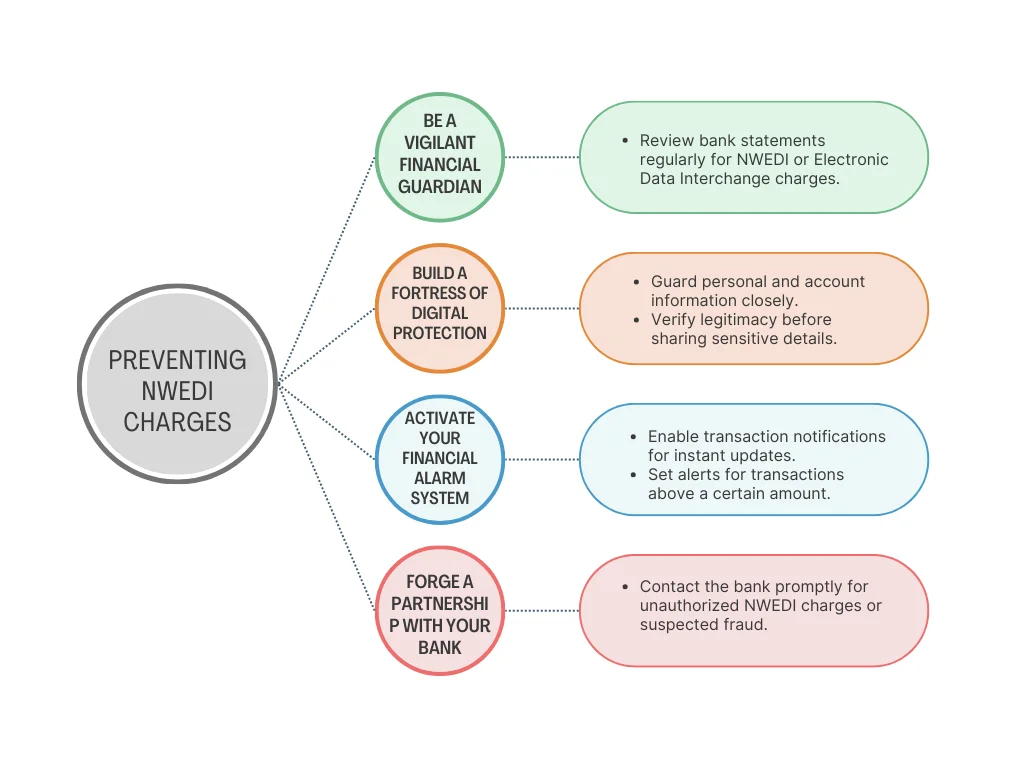

Take Charge of Your Financial Security: Preventing NWEDI Charges

While NWEDI payments often represent legitimate transactions, it’s crucial to take proactive measures to protect your finances and prevent unauthorized charges. Here are key strategies to secure your accounts and ensure peace of mind:

1. Be a Vigilant Financial Guardian

- Review bank statements regularly like a detective scanning for clues. Look for any unfamiliar charges, especially those mentioning NWEDI or Electronic Data Interchange. Report any unauthorized activity to your bank immediately.

- Treat your payment information like precious jewels. Share card details only on secure, reputable websites. Be wary of phishing attempts and avoid sharing sensitive information on unsecured platforms.

2. Build a Fortress of Digital Protection

- Guard your personal and account information closely. When interacting with unknown individuals or companies, verify the legitimacy of requests before providing any sensitive details.

- Construct strong passwords for your online banking and payment accounts. Use unique combinations of letters, numbers, and symbols, and consider using a password manager to securely store and manage them.

3. Activate Your Financial Alarm System

- Enable transaction notifications offered by your bank. Set up alerts to receive instant updates on account activity, particularly transactions above a certain amount. This allows you to quickly identify any suspicious activity.

- Exercise caution in the digital realm. Be wary of sharing information online or responding to emails, calls, or messages regarding your finances. Verify the authenticity of communications before providing any personal or financial details.

4. Forge a Partnership with Your Bank

- Contact your bank immediately if you notice unauthorized NWEDI charges or suspect fraudulent activity. They can swiftly block your card, investigate the charges, and provide further guidance on protective measures.

Remember, prevention is the best defense. By implementing these proactive measures, you can significantly reduce the risk of NWEDI charges and enhance the overall security of your financial transactions. Stay vigilant and take control of your financial well-being!

The Importance of Understanding Bank Charges

In a world where financial transactions occur with increasing frequency, understanding every entry on your bank statement is vital. Whether it’s NWEDI payments or an unknown charge labeled XYZ, being aware of your financial activity ensures a proactive approach to your financial security.

Periodically checking your bank statement should become a habit, offering assurance that no unauthorized or unsolicited transactions go unnoticed. It’s a proactive measure that not only aids in the swift identification of potential issues but also contributes to your overall financial well-being.

Conclusion

The appearance of “NWEDI” on your bank statement may initially raise questions, but armed with the knowledge provided in this guide, you can approach it with confidence. NWEDI represents the utilization of Electronic Data Interchange by Nationwide Building Society, streamlining their payment processes for enhanced efficiency and security.

Remember, maintaining a vigilant eye on your financial transactions, employing secure practices, and understanding the systems in place contribute to a robust defense against potential issues. So, the next time you encounter NWEDI on your bank statement, embrace it as a testament to the evolution of secure electronic transactions rather than a cause for unnecessary worry. Stay informed, stay secure.

Read out What Does GPC EFT Mean on a Bank Statement?