Have you ever glanced at your bank statement and spotted a mysterious charge labeled “TLP”? If so, you’re not alone. Understanding what this abbreviation stands for and its implications is crucial for managing your finances effectively. In this guide, we’ll delve into the world of TLP charges, shedding light on what they are, how they appear on your statement, and what steps you can take to prevent unauthorized charges.

What is TLP on my bank statement?

TLP, short for Total Loss Protection, is a financial term that often appears on bank statements. In the realm of banking, TLP signifies a specific charge related to insurance coverage, particularly concerning vehicles. When you see TLP on your statement, it indicates a transaction associated with Total Loss Protection coverage for your vehicle.

Also read What Is the 365 Market Charge on Your Bank Statement.

What does TLP stand for in banking?

In banking terminology, TLP stands for Total Loss Protection. This coverage comes into play when a vehicle is declared a total loss due to factors such as accidents or theft. Instead of covering the difference between the insured value of the vehicle and any outstanding loan or lease balance (as with GAP coverage), TLP provides financial relief toward acquiring a replacement vehicle.

What Is the TLP Bank Charge?

Imagine this scenario: Your car gets involved in a severe accident, resulting in substantial damage beyond repair. In such unfortunate circumstances, your insurance company may deem the vehicle a total loss. This is where TLP, or Total Loss Protection, comes into play.

How Does the TLP Bank Charge Look Like?

The appearance of the TLP bank charge may vary slightly depending on your bank or financial institution. However, most banks provide clear and concise transaction details, making it relatively easy to identify the TLP charge among other transactions.

Let’s break down how the TLP bank charge looks on your statement:

- Transaction Date: [Date of the TLP charge]

- Transaction Description: Total Loss Protection or TLP

- Transaction Amount: [Amount charged for Total Loss Protection]

- Reference Number: [Transaction reference number, if applicable]

- Merchant or Source: [Name of the insurance company or financial institution providing the coverage]

- Description: [Additional details about the TLP charge, if provided by the bank]

Example:

- Transaction Date: 2023-07-15

- Transaction Description: Total Loss Protection

- Transaction Amount: $50.00

- Reference Number: TLP20230715

- Merchant or Source: ABC Insurance Company

- Description: Total Loss Protection coverage for your vehicle

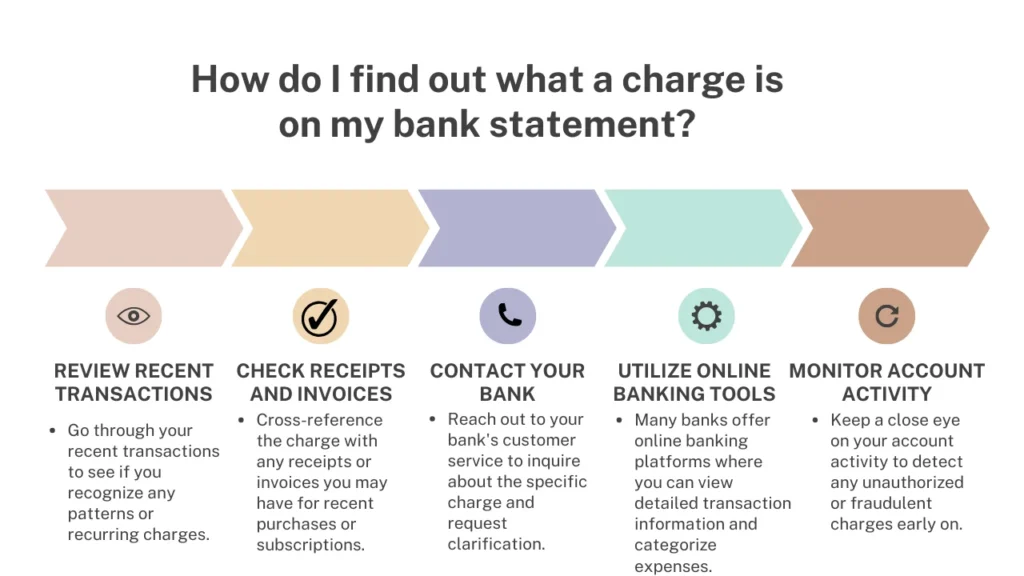

How do I find out what a charge is on my bank statement?

If you come across an unfamiliar charge on your bank statement, it’s essential to investigate promptly. Here are some steps you can take to identify an unknown transaction:

- Review Recent Transactions: Go through your recent transactions to see if you recognize any patterns or recurring charges.

- Check Receipts and Invoices: Cross-reference the charge with any receipts or invoices you may have for recent purchases or subscriptions.

- Contact Your Bank: Reach out to your bank’s customer service to inquire about the specific charge and request clarification.

- Utilize Online Banking Tools: Many banks offer online banking platforms where you can view detailed transaction information and categorize expenses.

- Monitor Account Activity: Keep a close eye on your account activity to detect any unauthorized or fraudulent charges early on.

How do you identify an unknown transaction?

Identifying an unknown transaction requires a systematic approach and attention to detail. Here’s how you can effectively pinpoint unfamiliar charges on your bank statement:

- Scrutinize Transaction Details: Carefully examine the transaction date, description, and amount to gather clues about its origin.

- Cross-Reference with Records: Compare the transaction details with any records you have, such as receipts, invoices, or subscription confirmations.

- Verify with Authorized Users: If you share the account with family members or colleagues, check if anyone authorized the transaction.

- Monitor for Fraudulent Activity: Stay vigilant for any signs of unauthorized transactions or suspicious account activity.

- Report to Your Bank: If you’re unable to identify the transaction, report it to your bank immediately for further investigation.

Know about FDMS Charge on Bank Statement.

How to Prevent Unauthorized TLP Bank Charges?

Preventing unauthorized TLP bank charges requires proactive measures to safeguard your financial information and accounts. Here are some steps you can take to minimize the risk of unauthorized charges:

- Monitor Account Activity: Regularly review your bank statements and transaction history to detect any unusual or unauthorized charges promptly.

- Set up Account Alerts: Utilize your bank’s notification features to receive alerts for large transactions, unusual activity, or low balances.

- Secure Personal Information: Safeguard your personal and financial information, such as account numbers, passwords, and PINs, to prevent unauthorized access.

- Use Secure Payment Methods: When making online purchases, opt for secure payment methods, such as credit cards with fraud protection, and avoid sharing sensitive information on unsecured websites.

- Enable Two-Factor Authentication: Enhance the security of your online accounts by enabling two-factor authentication, which adds an extra layer of verification for accessing your accounts.

- Be Wary of Phishing Attempts: Stay vigilant against phishing attempts by avoiding clicking on suspicious links or providing personal information in response to unsolicited emails or messages.

- Report Suspicious Activity: If you notice any suspicious or unauthorized charges, report them to your bank immediately and take the necessary steps to secure your accounts.

Conclusion

In conclusion, understanding TLP charges on your bank statement is essential for managing your finances effectively and protecting yourself from unauthorized transactions. By familiarizing yourself with Total Loss Protection and staying vigilant against fraudulent activity, you can safeguard your financial well-being and ensure peace of mind when reviewing your bank statements.

Read to know CSC ServiceWorks Charge On Your Bank Statement.

Remember to monitor your account activity regularly, utilize security features provided by your bank, and report any suspicious charges promptly to mitigate the risk of financial loss.